Aging and Health

The racially and ethnically diverse people who make up the generation in their 60s today are healthier and living longer than their parents did. By 2050, the world’s population age 60 and older is expected to total two billion, up from 900 million in 2015. While longer life outcomes present opportunities for individuals, families and the society overall, they also come with challenges. I lost a grandmother this year—she was 89 years young—and I appreciated every day that she blessed me on this earth. Unfortunately, her passing also reminded my family members and me of some hard realities – not only were her last few years clouded by health concerns but the family experienced financial strains that impacted her long-term care options. In this day of increased longevity, we must consider how health and economic inequities are widening for people over 60, especially in the wake of the COVID-19 pandemic.

Aging and Rising Living Costs

My grandmother was a typical Black woman who single-handedly raised five kids and worked numerous jobs for years to avoid the welfare system. She finally landed a job with the Upjohn Company (now Pfizer) as a pill packer and worked there for 21 years until her retirement in 1992. As years went by, it became obvious that her fixed income from Social Security and Supplemental Security Income (SSI) was not keeping up with the rising cost of living. My grandmother, like many other Black adults 65 years and older, worked hard all her life but struggled with rising housing and health care bills, little-to-no savings and no room for any major adverse life event. Fortunately, our family stepped in, pooled our resources and provided what she needed.

According to the National Council on Aging (NCOA), there are clear disparities that older adults are experiencing in the U.S. when it comes to economic security:

- More than 15 million (or roughly one in three) adults age 65+ are economically insecure, with incomes below 200% of the federal poverty level. (Kaiser Family Foundation, 2018)

- More than half of Black and Hispanic people age 65+ have incomes below 200% of the federal poverty level. (Kaiser Family Foundation, 2018)

- The 2.3 million older adults on Supplemental Security Income receive, on average, just $475 each month. (Social Security Administration, 2021)

- 21% of married Social Security recipients and 43% of single recipients age 65+ depend on Social Security for 90% or more of their income. (Social Security Administration [SSA], 2016)

- 61% of households headed by an individual age 65+ had debt in 2016. The median debt of older households was $31,050. (Survey of Consumer Finances, 2019)

- About half of households headed by an individual age 55+ have no retirement savings. (Government Accountability Office, 2019)

Limited income, rising inflation driven by recent shortages of goods, increased health concerns and expenses, and the rising price of housing all contribute to the precarious economic state many older individuals face. They can’t live comfortably, stress-free and on their own terms. Older people of color and women may need to confront other markers of inequality such as gentrification, concentration of poverty, low wages, limited retirement benefits and unequal pay.

Aging and Income Inequality

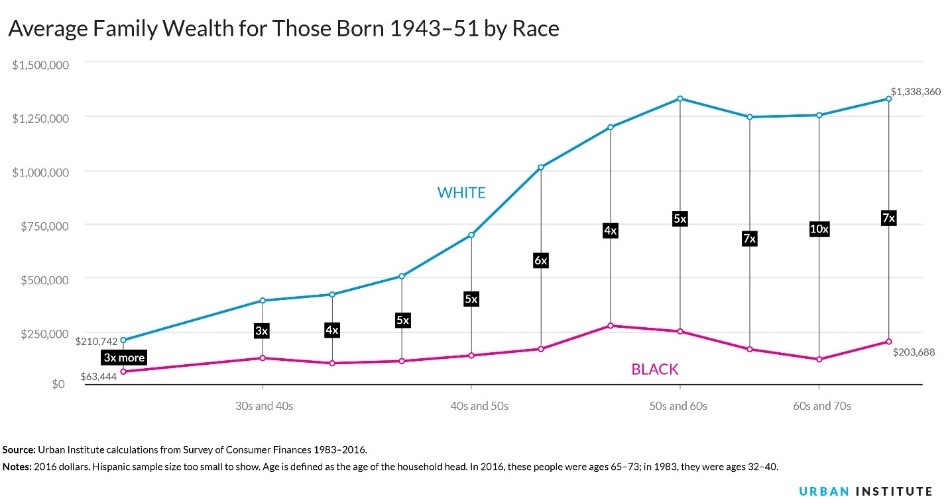

Income is money coming into a household, while wealth is a family’s assets minus their debts. Data shows that White individuals accumulate more wealth over their lives than Blacks or Latinos, only widening the gap. While racial wealth disparities are greater than income disparities in the Unites States, the differences in earnings add up over a lifetime and impact a person’s ability to save and invest in themselves – to even prepare for retirement. For example, in 2016, White families had over six times more in average liquid retirement savings than Black and Latinx families. With traditional pension plans continuing to be replaced by 401(k)s as vehicles for savings, we need to consider additional types of support employers could provide.

On average, women age 65 or older have a median household retirement income of $47,244, only 83% of their male counterparts’ average income of $57,144. Several factors--like wage gaps, lower SSI payments, caregiving responsibilities and longer life spans--contribute to this gap. Black women fare even worse.

Despite Congress’ enacting the Age Discrimination in Employment Act (ADEA) of 1967, discrimination in the workplace is still a major contributor to income inequality. The ADEA prohibits employment discrimination against people 40 and older. Older workers are experiencing workplace biases in recruitment, type or quality of jobs attained and promotion and training opportunities. A recent AARP survey found that 76% of these older workers see age discrimination as a hurdle when they look for a new job. As a result, many older workers are finding themselves in early retirement or in low-wage jobs with little-to-no benefits. The added intersectionality of gender and race only compounds these disparities.

Ensuring Economic Security

Income inequality translates into financial insecurity in retirement. Americans have increased concerns about achieving economic security because of COVID-19, and government programs are needed even more. The future workforce for older people of color and women in particular, will continue to be challenged if we don’t implement policies and practices that work to dismantle current discrimination practices. The racial wage, wealth, and debt gap will continue to impact individuals’ ability to have quality of life in retirement. As the world opens, let’s reimagine what policies and practices could better equip low-income individuals to have the economic stability and mobility needed to drive preparedness of our aging community. To provide insight into the perceptions of American workers and retirees about the needs and issues surrounding retirement, the Retirement Confidence Survey recently released their 31st report, along with a special report that takes a deeper look at what other factors should be considered when developing financial tools and resources for Black and Hispanic Americans. For example, SSI should be updated and expanded to raise asset and income limits, eliminate marriage penalties, ease eligibility restrictions for immigrants and residents of U.S. territories and simplify complex and intrusive rules.

Financial institutions, especially retirement companies, have an opportunity to get ahead of the curve and pilot products that increase the retirement readiness of this growing population. Without adequate intervention, our aging community will continue to be trapped in a cycle of asset poverty that is damaging to them, their families and the larger economy, especially for those of color. My grandmother is a perfect example of someone who worked long, hard and tirelessly but whose income and wealth didn’t align; as a result, she couldn’t live stress-free in her golden years. As a society, it’s time for us to do better.